If the nobody-could-have-seen-it-coming black swan metaphor was the narrative of the 2008 market meltdown, author and strategist Michele Wucker’s highly probable, obvious “gray rhino” metaphor tells the story of the crisis we are in today.

Amid the double calamities of the COVID-19 pandemic and market meltdown, both of which followed repeated public warnings that went ignored, the gray rhino has struck a chord and generated a flood of headlines around the world.

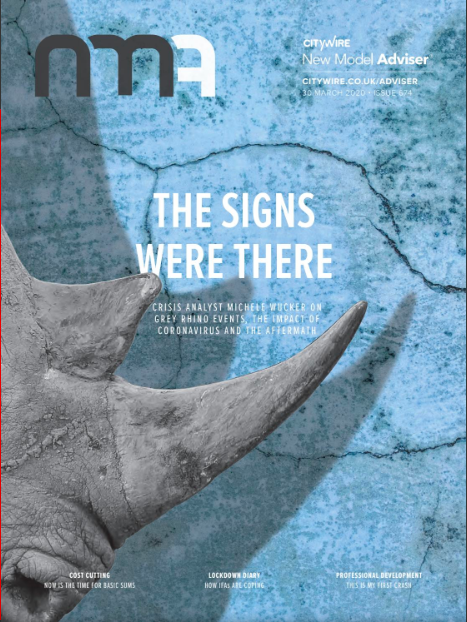

Crisis Response Journal recently called the gray rhino “A metaphor for our times.” The UK financial magazine, New Model Advisor, made the gray rhino the cover story of its new issue, relegating the black swan to a sidebar.

Nassim Taleb, who coined the term “black swan” for highly improbable and unforeseeable events, has declared on twitter and in multiple interviews, including on Bloomberg News, that the combined pandemic and financial crisis was and is not a black swan. It was neither unforeseeable nor even improbable.

Michele coined the term “gray rhino” to draw attention to the obvious risks that are neglected despite – indeed, often because of– their size and likelihood. The gray rhino metaphor has moved markets, shaped financial policies, and made headlines around the world. She introduced it at the World Economic Forum Annual Meeting in Davos in 2013, and developed a five-stage analytical framework in her 2016 book, THE GRAY RHINO: How to Recognize and Act on the Obvious Dangers We Ignore, which has sold hundreds of thousands of copies around the world and influenced China’s financial risk strategy.

Michele’s recent Washington Post op-ed challenged the tired black swan trope that has given portfolio managers and policy makers a convenient “nobody saw it coming” cop-out when they ignore obvious dangers: “Let’s trade the black swan for the gray rhino: a mind-set that holds ourselves and our government accountable for heeding warnings and acting when we still have a chance to change the course of events for the better instead of waiting for a crisis to act.” The Wall Street Journal quoted her Washington Post article, offering the gray rhino as an alternative to the black swan.

Axios, Fast Company, and The Economist’s The World Ahead podcast have adopted the gray metaphor to describe this crisis. The term also has made pandemic and financial collapse related headlines in Australia, China and Taiwan (too many articles to link), Japan, South Korea, Cambodia, Pakistan, Sri Lanka, Thailand, the Middle East, South Africa, Belgium, Denmark, France, Germany, Italy, Spain, Greece, the Czech Republic, Chile, Venezuela, Canada, and Mexico.

The black swan has been misused to normalize complacency. By contrast, the gray rhino provides an alternative that challenges decision makers to be held accountable for failing to prepare for and head off clear and present dangers.

It provides not only a new way to think about the twin pandemic and financial crises, but also a framework for how we can do a better job holding decision makers accountable when they fail to keep threats from turning into catastrophes. As Crisis Response Journal put it, the gray rhino is indeed a metaphor for our times.